Samsung to make Tesla’s HW 4.0 self-driving auto chip

The Korean tech giant has apparently outrivaled top foundry player TSMC to win the transaction, sources say

By Sep 23, 2021 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

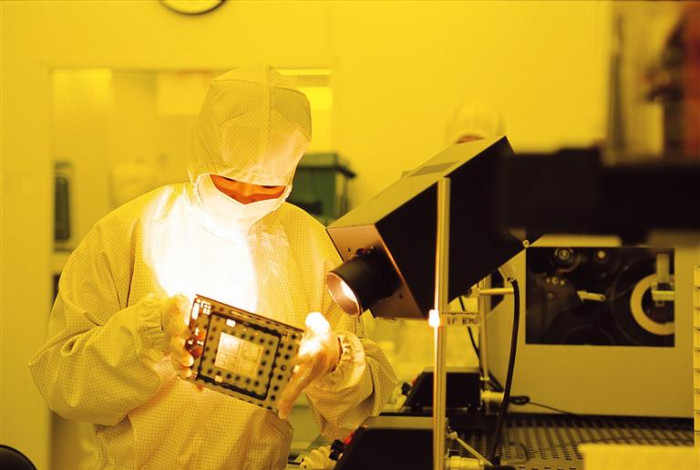

SILICON VALLEY – Samsung Electronics Co., the world’s leading chipmaker, will manufacture Tesla Inc.’s next-generation hardware 4 (HW 4.0) chip for the top US electric carmaker’s fully autonomous driving technology.

According to multiple industry sources on Thursday, Samsung is certain to beat bigger foundry rival Taiwan Semiconductor Manufacturing Co. (TSMC) to win the contract.

“Tesla and Samsung’s foundry division have been working on the design and samples of the chip from the start of this year. Recently, Tesla decided to outsource the HW 4.0 self-driving chip to Samsung. It’s virtually a done deal,” said one of the sources.

Samsung Electronics plans to mass produce the Tesla HW 4.0 chip at its main Hwasung plant in Korea using the 7-nanometer processing technology in the fourth quarter of this year at the earliest, according to the sources.

The 7 nm process is less advanced than its 5 nm process, but Samsung has decided to use the 7 nm technology to ensure higher production yields and stable functions of the chip when installed on full self-driving (FSD) cars, they said.

“Tesla and Samsung agreed on the 7-nanometer process to ensure the safety of Tesla’s next-generation electric vehicles,” said another source.

HW 4.0, dubbed the FSD Computer 2, is the successor to the HW 3.0 chip used in Tesla’s current vehicles. The HW 3.0 chip was manufactured by Samsung.

TESLA PICKED SAMSUNG OVER TSMC

The expected partnership between Samsung and Tesla comes amid media reports from Taiwan that Tesla was working on the production of its HW 4.0 chip with TSMC, the world’s largest foundry chipmaker.

However, sources said Tesla decided to partner with Samsung for the production of its next-generation autopilot chip after taking into account factors such as production costs, the possibility of long-term cooperation and the availability of Samsung technology in Tesla designing its own chips.

Back in 2016, the US EV giant started building a team of chip architects to develop its own silicon and design efficient chips for self-driving.

Industry officials said Samsung’s strengthened partnership with Tesla will enhance its presence in the global foundry market as the US company aims to expand its fully autonomous EV lineup.

Tesla plans to unveil its all-electric pickup, the Cybertruck, in late 2022 and has already received 1.2 million units in pre-orders. The HW 4.0 computer is widely expected to be mounted on the Tesla Cybertruck.

Several automakers are set to offer electric pickups in the coming years in line with the Biden administration’s push for half of new cars sold in the US to be electric by 2030.

Hyundai Motor Co., Korea’s top automaker, also plans to roll out an electric version of the Santa Cruz pickup, its first truck model for the American market, to enter the hotly contested segment.

GOOGLE, AMAZON, XIAOMI ON SAMSUNG’S RADAR

Samsung is the world’s second-largest foundry player but has been struggling to narrow the wide market-share gap with bigger competitor TSMC.

The Korean tech giant is known to be spending over 10 trillion won ($8.5 billion) annually in its foundry business since 2019 but its global foundry market share has largely been stuck in the 10% range.

According to market researcher TrendForce, TSMC is the biggest foundry player, controlling 52.9% of the global market as of the second quarter, followed by Samsung with a 17.3% market share.

While TSMC counts Apple Inc. and Advanced Micro Devices Inc. (AMD) among its major customers, Samsung is striving to strengthen its partnerships with tech companies such as Google and Amazon.

Earlier this month, Google said its Pixel 6 smartphone set to be released in October will be equipped with the Tensor chip that it has developed. Google has partnered with Samsung over the design and production of the application processor (AP) chip.

China’s top handset maker Xiaomi is also said to be working with Samsung to develop an AP chip for its smartphones.

TSMC and Samsung have been upping the ante to stay ahead by advancing technology and expanding facilities, particularly in the US.

While TSMC plans a $37 billion US investment to expand and upgrade its foundry facilities in North America, Samsung said in May it will invest $17 billion in the US to build a next-generation foundry plant.

According to industry officials, Taylor, a city in Williamson County of Texas, is the most likely site for Samsung’s new foundry plant. Taylor is about 50 km northeast of Austin, where Samsung’s current foundry facilities are located.

Analysts expect Samsung’s foundry business to post more than 1 trillion won in operating profit next year with its market share rising above 20%, up from an estimated 300 billion won this year.

The global foundry market is forecast to exceed $100 billion this year from $87.3 billion in 2020, according to semiconductor market research firm IC Insights.

Write to Jeong-Soo Hwang at hjs@hankyung.com

In-Soo Nam edited this article.

-

Tech, Media & TelecomSamsung’s new foldables: Game changer in smartphones

Tech, Media & TelecomSamsung’s new foldables: Game changer in smartphonesAug 11, 2021 (Gmt+09:00)

4 Min read -

Korean chipmakersLegendary chip architect Jim Keller may team up with Samsung Electronics

Korean chipmakersLegendary chip architect Jim Keller may team up with Samsung ElectronicsNov 18, 2021 (Gmt+09:00)

2 Min read -

Korean chipmakersSamsung unveils 2.5D chip packaging tech for high-end products

Korean chipmakersSamsung unveils 2.5D chip packaging tech for high-end productsNov 12, 2021 (Gmt+09:00)

1 Min read -

Korean chipmakersUncertainty clouds Samsung as paradigm shifts toward profitability

Korean chipmakersUncertainty clouds Samsung as paradigm shifts toward profitabilityOct 28, 2021 (Gmt+09:00)

4 Min read -

Korean chipmakersSamsung to make 2-nanometer GAA chips by 2025 to overtake TSMC

Korean chipmakersSamsung to make 2-nanometer GAA chips by 2025 to overtake TSMCOct 07, 2021 (Gmt+09:00)

3 Min read -

Korean chipmakersSamsung, ARM chip design partner Gaonchips eyes IPO in 2022

Korean chipmakersSamsung, ARM chip design partner Gaonchips eyes IPO in 2022Sep 29, 2021 (Gmt+09:00)

1 Min read -

Korean chipmakersLG Innotek, Samsung Electro-Mechanics benefit from wafer shortage

Korean chipmakersLG Innotek, Samsung Electro-Mechanics benefit from wafer shortageSep 06, 2021 (Gmt+09:00)

3 Min read -

-

Korean chipmakersSamsung overtakes Intel as foundry looms as next battlefield

Korean chipmakersSamsung overtakes Intel as foundry looms as next battlefieldAug 02, 2021 (Gmt+09:00)

3 Min read